Second Quarter 2023 Market and Economic Review

Domestic Recap for Q2

For the most part, the storyline driving domestic markets can be told in three parts: the debt ceiling, Federal Reserve activity and forecasts on interest rates, and a significant market disconnect.

At the start of the year, the debt ceiling became a national and global storyline when Congress struggled to agree on a budget, and the GOP used the debt ceiling as leverage to achieve some of its desired cuts. As we moved into the second quarter, that storyline became more pronounced as commentators and politicians made a lot of noise surrounding the dire economic position each party was putting us in. And there’s no doubt that the U.S.’s inability to continue to borrow money would have far-reaching negative consequences, but there was very little reaction from the markets in the build-up to the June deadline. There was also very little market reaction after an agreement was made to raise the debt ceiling.

The reaction, or lack thereof, was quite contrary to a similar situation in 2011 when the U.S.’s long-term credit rating was actually down-graded by Standard and Poor’s to AA-plus. That year, Congress’ tug-of-war with the debt ceiling triggered a significant market sell-off followed by a noticeable rebound once a deal was struck. Essentially, the markets this year simply assumed that the debt ceiling would inevitably be raised before the deadline. This attitude is reflected by a relatively low VIX reading — the volatility index that provides a real-time measurement of market uncertainty to project volatility over the next 30 days — throughout the ordeal.

The Fed’s continued manipulation of interest rates was another major storyline, although for different reasons than the past few quarters. During the quarter, the Fed began to telegraph that it was likely to pause rate hikes after a series of 10 increases dating back to March 2022. The hints of a pause were realized when the Fed chose to leave the rate unchanged in their June meeting. The markets positively received this news, but perhaps not as much as you might expect, leading us to the third storyline – a disconnect in the markets.

On the surface, the markets – particularly the S&P 500 – appear to be moving forward very nicely despite inflation concerns, debt ceiling worries, and potential recession on the horizon. A closer look, however, shows a significant divide in the S&P 500 between who is doing well and who isn’t. Of those 500 companies, the capital is heavily weighted to a very small number of companies at the top of the list. For instance, Apple now controls over 7.5 percent of the entire index. Microsoft’s index weight stands at about 6.76, and the top 10 companies combined hold nearly a third of the entire index’s weight, resulting in a large disparity in returns that can be invisible to the casual observer.

The cap-weighted S&P 500 showed up around 14 percent for the quarter, largely thanks to those very large companies at the top. However, the equal weight S&P 500 – where each company is assigned a fixed weight (0.2 percent) – was up only 3.5 percent. Well over half the companies in the index are negative for the year.

Why? Because the underlying market was (and, perhaps, still is) concerned about the debt ceiling crisis. Those investors were/are concerned about the Fed’s approach to interest rate hikes to combat ongoing inflation. And they are concerned about an overall economic slowdown (and recession) to the point of shifting a significant portion of overall investments towards stocks viewed as higher quality and safer investments.

Recession Realities

The prospect of recession is still a widely debated topic among economists. Some would argue that we’ve already experienced the start of a recession based on the old axiom of two consecutive quarters of negative GDP growth, which we experienced at the beginning of 2022. Others counter that true recession depends on a much broader set of variables, several of which show we are not in a recession. Still, many economists anticipate a recession by the Fall of this year, but some data points just aren’t showing it.

For instance, GDP has rebounded with positive results in each of the last three reported quarters (Q3 2022 – Q1 2023) with growth percentages between 2.0 and 2.9 percent. Likewise, unemployment is relatively low at 3.7 percent at the end of May. And the real estate market continues to defy the odds – despite sharply rising interest rates, new home starts continued to rise throughout the second quarter.

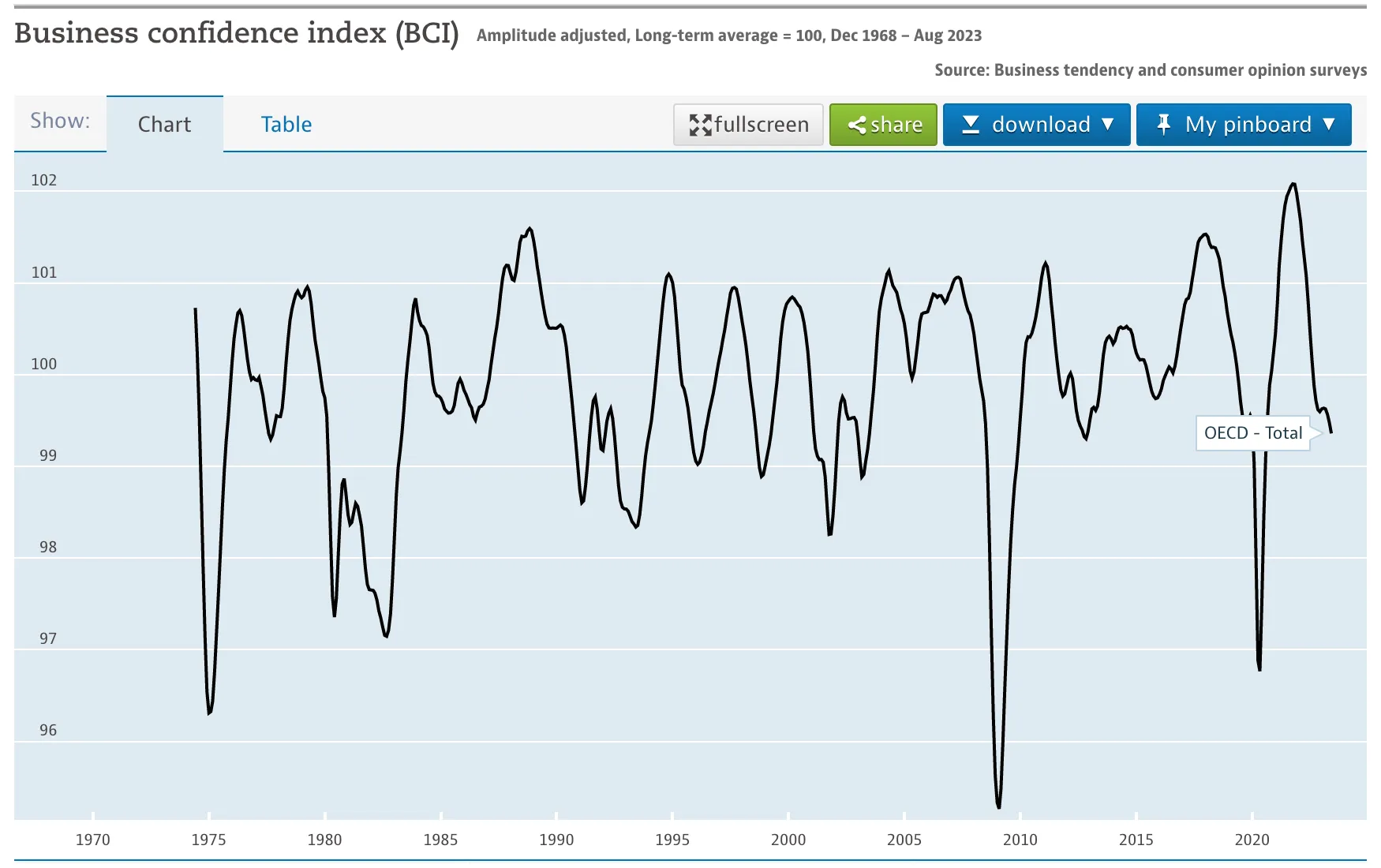

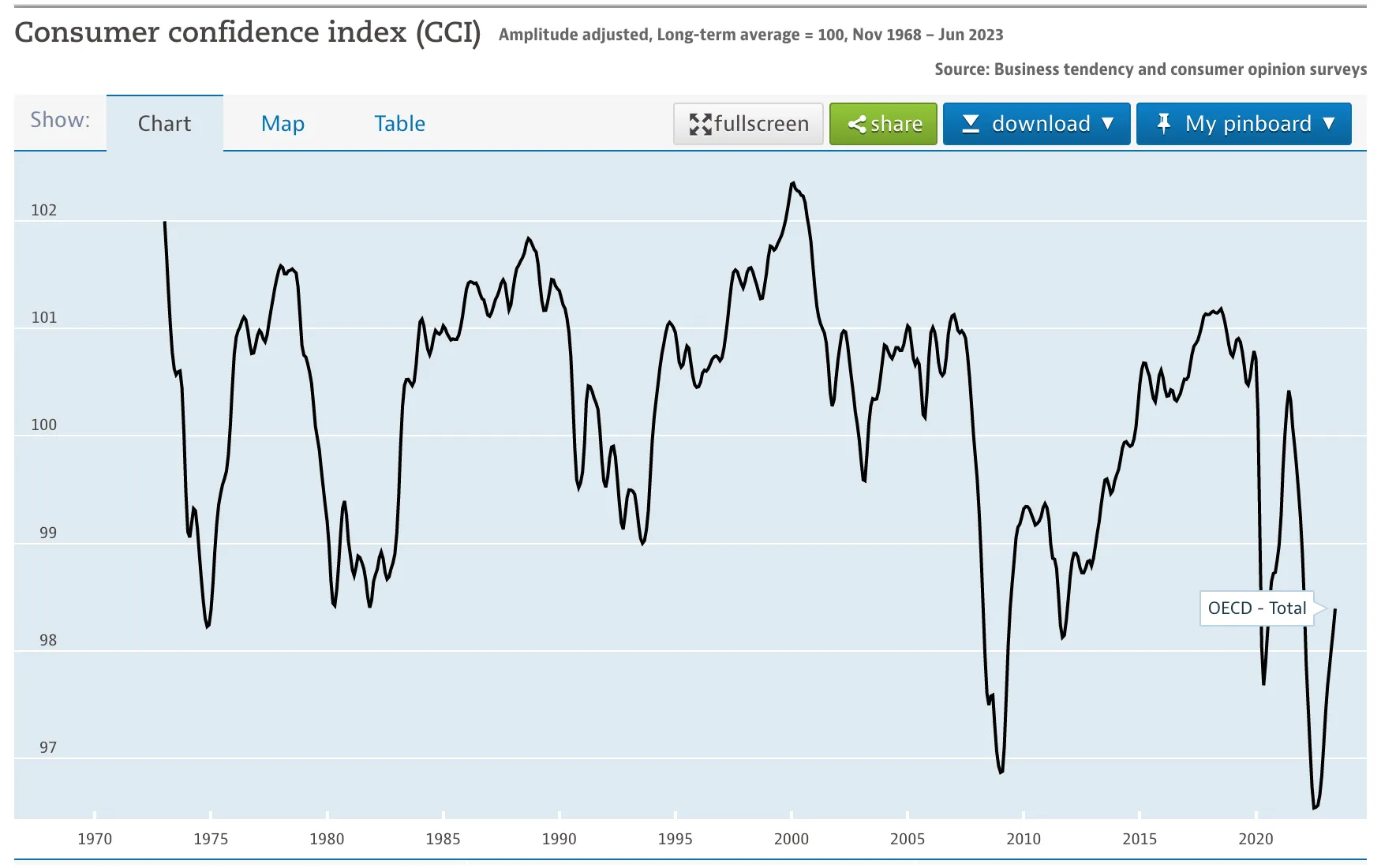

However, based on cumulative LEIs (leading economic indicators), the overall projection is that we are still trending toward a recession, but the timing is more likely to be 2024. One such key indicator – the Business Confidence Index – is particularly telling. Business confidence is coming down from an all-time high in October of last year but has dropped sharply since to relatively average levels. Consumer confidence is trending up, but that index must recover from all-time lows and is still well-below average (see charts below).

Global Outlook

The supply chain issues that began in the aftermath of Covid shutdowns continue to improve but are still short of 2019 flows. Notably, chips for the auto industry and computers have recovered to pre-pandemic levels, as has the lumber industry.

One of the bigger challenges on the international scene is the current rocky relationship between the U.S. and China. From a political standpoint, both U.S. political parties mostly agree on their cautiousness towards China. And there are valid arguments for that approach concerning national security and protecting domestic jobs. But something that often gets lost in the political rhetoric is that hammering those agendas against China also hampers our ability to suppress already high inflation rates. International trade, especially with China, is what allows many companies (and, subsequently, individual consumers) to acquire the goods they need and want at the lowest possible prices.

That kind of nationalism isn’t confined to just the U.S., and the globe is becoming increasingly sectorized from an economic standpoint. As that continues, the result will be higher consumer prices due to a lack of access to lower-priced, competitive items available from other countries. Compounding the issue is that many of these countries are dealing with excessive and growing national debt. As the U.S. just dealt with its own debt ceiling debate, other countries will have to grapple with similar challenges but from a much weaker global economic standing. At this point, they become a less attractive market for the U.S. (and other countries) to sell into, and the situation spirals down to issues of civil unrest and other situations. These are all factors that Richard P. Slaughter Associates is keeping a watchful eye on.

What We’re Watching Now

Overall, the state of the investment markets is probably best described as confused. Generally, any rate hike by the Fed takes approximately 6-9 months to work itself through the economy before its impact is fully known. For the past year, the Fed has stacked one increase after another pushing inflation down from 9 percent to 4 percent, which is still above the Fed’s target of 2 percent. Despite that, housing is still strong, GDP is positive, and inflation is still moderately high. At a glance, it appears that the Fed’s rate increases still have some work to do and that the Fed’s forecast for more increases to come may be warranted. However, the impact of the last several increases is just getting started, which has many economists claiming that the Fed may be making rate cuts before the end of the year. These variables are why many investors are still feeling good about making investments but are doing so in a more cautious manner by steering towards large companies with proven track records.

While monitoring markets, economic conditions, and leading indicators for each, Slaughter Associates will continue to lean on our balanced approach with the flexibility to make allocation adjustments as needed to meet long-term goals.

MARKET AND ECONOMIC COMMENTARY